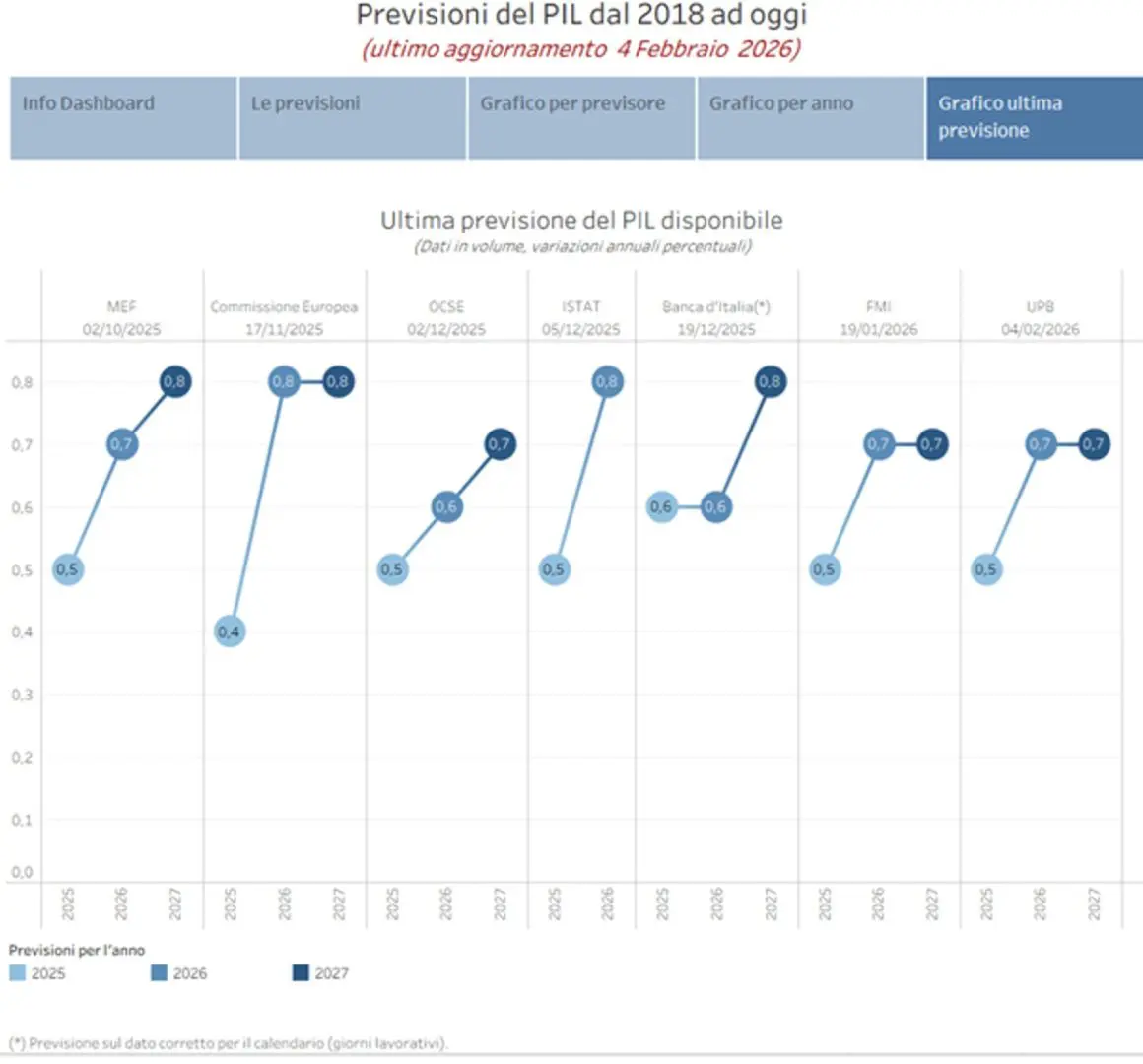

ROMA (ITALPRESS) – The parliamentary budget office estimates for 2025 a GDP growth of 0.5 percent on annual data and “prospect” then a strengthening of 0.7 percent in 2026, supported by internal demand and in particular by the implementation of the PNRR, and similar value for 2027. This is what emerges from the February Note of the UB which analyses, on the basis of the most recent indicators available, the framework of the international and national economic cycle, short-term trends and forecasts for Italy.

In particular, macroeconomic forecasts for the three-year period 2025-2027 are updated in the light of the latest developments in the region, developed by UPB models. According to estimates, Italy’s GDP, after a little more stagnant trend in the central quarters of 2025, accelerated in the fourth quarter to 0.3 percent, thanks above all to the boost of domestic demand.

On the basis of the preliminary quarterly accounts, GDP would be increased in 2025 by 0.7 percent, but the growth calculated on the annual data should be less than two tenth percentage point; the difference reflects the adjustment for working days (not considered in annual accounts) that in 2025 were three less than 2024. Therefore, the UB preconsumption sees a GDP of 0.5 percent on annual data for 2025.

The macroeconomic forecasts of the UB are expected to increase to 0.7 percent in 2026, supported by domestic demand and in particular by the implementation of the PNRR, and similar value for 2027. Compared to the autumn estimates prepared by the UPS for the validation of MEF forecasts in DPFP, the picture has been improved for 2026, in light of international hypotheses less penalizing for foreign demand and lower consumer prices; always in virtue of the new hypotheses the expectation on the GDP of 2027 has just been quashed.

The exposure to low risk is high, mainly due to the global context as well as to the moods of financial markets and climate change. The international scenario remains conditioned by high geopolitical uncertainty, with falls on energy prices, trade flows and market expectations. In response, investors increase exposure to shelter activities, such as gold and silver, whose prices have accelerated the upward trend for over two years, even considering the decline observed in recent days.

On the labour front, the positive trend continues but real wages still under pre-pandemia. In summer, the working input is growing, driven by the recovery of hours worked for the employee, especially in manufacturing and services. In the pre-visual scenario, employment would continue to expand at low rates, with a stabilisation of the unemployment rate around 6 percent.

The wage dynamic remains moderate, so the negative gap of wages remains wide in real terms compared to the pandemic period. Inflation in Italy remains limited (1.5 percent in 2025) and less than the euro area.

The consumption of households grows gradually, although the prudent attitude of households is confirmed by the propensity to savings (at 11.4 percent in the third quarter of 2025, on higher levels of about four points than the pre-pandemic period), while the expectations of households and enterprises remain oriented to stability. The investment rate remains around 23 percent of GDP, a relatively high value in historical comparison.

– Upb- infographic photos

(ITALPRESS).