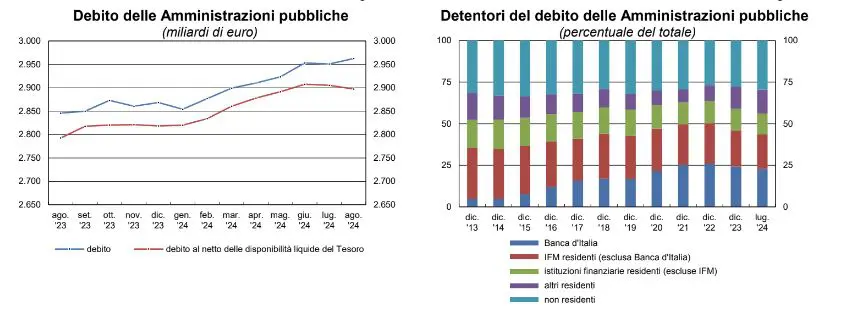

ROME (ITALPRESS) – In August, general government debt increased by 11.9 billion from the previous month to 2,962.5 billion. The increase was due to an increase in Treasury liquid assets (19.8 billion, to 65.2) and the overall effect of issue and redemption discounts and premiums, the revaluation of inflation-indexed securities and changes in exchange rates (0.2 billion), partially offset by the cash surplus (8.0 billion). With reference to the breakdown by sub-sectors, the increase in debt is attributable to that of central government (which grew by 12.1 billion); that of local government and social security agencies remained essentially unchanged. This is according to the Bank of Italy’s statistical publication “Public Finance: requirements and debt.”

The average residual maturity remained stable at 7.8 years. The share of debt held by the Bank of Italy decreased slightly (to 22.7 percent, from 22.9 in the previous month); in July (the latest month for which this data is available) that held by nonresidents increased slightly (to 29.4 percent, from 29.3 in June), while that held by other residents (mainly households and nonfinancial firms) remained stable at 14.4 percent. In August, tax revenues recorded in the state budget totaled 62.4 billion, up 13.4 percent (7.4 billion) from the same month in 2023. For the first eight months of the year, tax revenues totaled 371.7 billion, up 5.5 percent (19.2 billion) from the same period last year. Compared with data published last Sept. 16, general government debt was revised upward by 2.5 billion in 2020, 4.6 in 2021, 4.7 in 2022 and 5.0 in 2023. In addition to the effects of the General Review and the ordinary source update, the new estimates notably reflect a methodological change, agreed at the European level, in accounting for deferred interest on European Financial Stability Facility (EFSF) loans to Greece.

– Bank of Italy press office graphic –

(ITALPRESS).