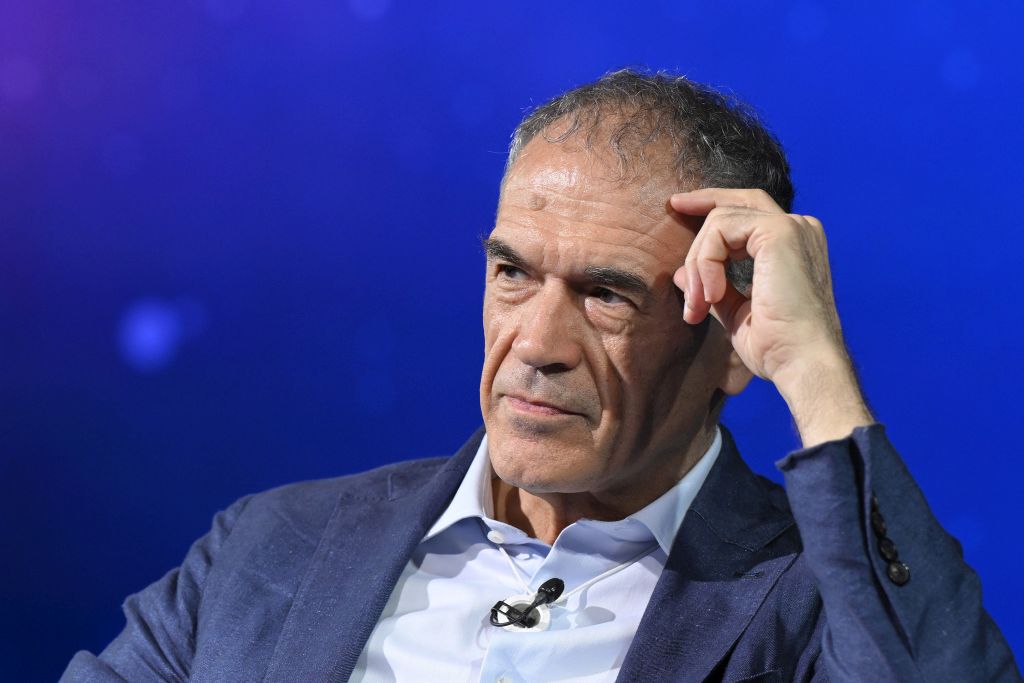

MILAN (ITALPRESS) – “A maneuver with many confirmations, starting with the wedge and Irpef cuts, and few novelties.” This is the thought of economist Carlo Cottarelli, director of the Observatory on Public Accounts at the Catholic University of Milan in an interview with Corriere della Sera.

“Compared to this year, the banks lose something in the immediate term, but at the end of the day it is a loan to the state: they pay more taxes in ’25-26 and then they will presumably pay less. Low income earners to whom some benefits are extended gain something while the middle class, especially those who do not evade, lose out. The government promised that it would cut taxes on the middle class this year, but it has not done so. Instead, in 2026-27 the bulk of the cuts will come, with a 1.8-point drop in primary spending. So all the deflation of government spending is postponed. Where the cuts? Not on health care, pensions and public investment. Instead, there will be cuts on spending on public employees, whose share of GDP will fall by about half a percentage point. Could it have been done differently? It depends on the political choices upstream. If one wants to cut taxes, one has to reform the structure of spending to minimize the impact on public services. Instead, linear cuts were made.”

For Cottarelli, the markets are promoting the Giorgetti administration: “I would say yes. He, for the first time in a long time, has saved part of the ‘treasury’ from increased revenues. So the deficit is half a point lower than the programmatic set in April: 3.8 percent of GDP versus 4.3 percent. There remains a big factor of uncertainty about the higher revenues, which the government considers all structural and which would be as much as 18 billion in 2025 and even more in the next two years. But Giorgetti, with the support of PM Meloni, has shown prudence in managing public accounts and the plan presented to Brussels is in line with the new EU rules. This guarantees the intervention of the ECB in case of an attack by the financial markets.”

– Photo: Photogram Agency –

(ITALPRESS).