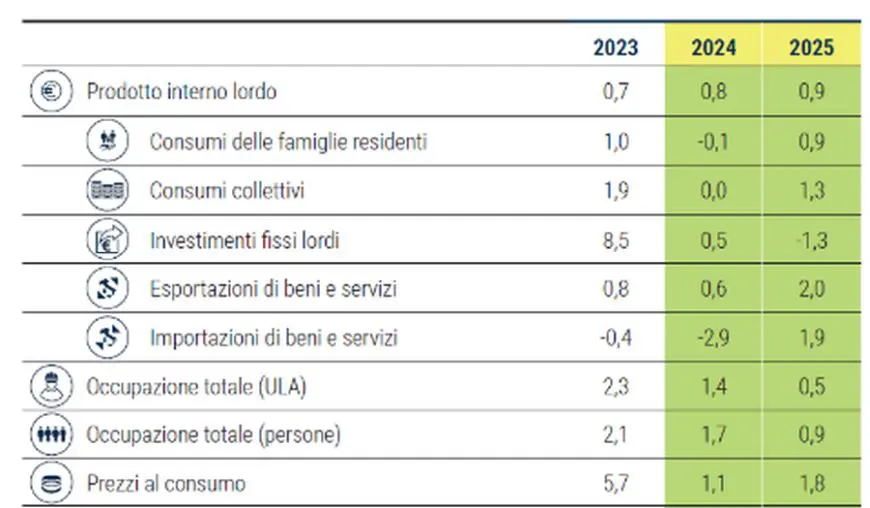

ROME (ITALPRESS) – GDP growth in Italy, following ISTAT’s revision, stands at +0.8 percent this year and 0.9 percent next year, in line with the government’s estimate under current legislation. It is also broadly in line with Eurozone growth, despite tighter monetary policy in Italy, the country with the lowest inflation in Europe (at 0.7 percent annually in September, 1.7 percent in the Eurozone). This is according to the autumn 2024 forecast report of the Confindustria Study Center, presented to the Chamber. GDP dynamics in the average 2024 will be supported mainly by net exports and to a lesser extent by gross fixed capital formation. In 2025, however, household consumption will be the driving force. “In Italy, growth is 0.4 percent over the first half of 2024, a positive percentage even against inflation of 0.7 percent. A 0.4 percent driven almost entirely by the dynamics of services, while in the other sectors value added has fallen,” explained Alessandro Fontana, director of the Confindustria Study Center, who presented the report. “We have a particular phase where construction is affected by the end of the superbonus, while industry is almost always in the negative in terms of value added growth. The particular is that only some industry sectors are decreasing, such as leather goods, clothing, while others, such as defense but also paper, are in moments of overall positivity,” he added. Another issue of substantial relevance is that related to NRP investments, with tranches that in Italy are higher than in other European Union countries, with a widespread awareness of the first-level contribution that the National Recovery and Resilience Plan will be able to provide to Italy: “On the NRP we have a substantial mass of resources to spend, more than one hundred billion, between this year and next. Half of these will be spent this year, according to our forecasts, and two-thirds next year. A very important sum, also comparatively to other European countries, compared to which we are at an advantage,” Fontana stressed. “The recovery of real wages also continues, in the public as in the private sector. For the latter, 40 percent of the loss of purchasing power has been recovered, in the face of low inflation, while in the public real wages are still in the negative 9 percent. In a rapid time, however, Italy is trying to catch up in terms of wages, while as far as exports are concerned, the greatest contribution to growth will come from net exports, this due to a sharp fall in imports, influenced by energy supplies that are lower than in the past.”

Happy notes to which are flanked by the knots of the present, which in Italy are now recognized in labor, housing and green policies, with high support costs that, especially in the latter two cases, slow down the mobility of workers and affect the competitiveness of companies: “We need to keep the attractiveness of work in Italy high, within a complex scenario of the relationship between demographic decline and shortage of workers,” the director of the Confindustria study center notes again. “Between 2024 and 2028 the demographic component, taking into account the migration balance, will bring a lower labor supply corresponding to 520,000, thus having in four years a need for 850,000. There is certainly opportunity to intervene on increasing the employment rate, but this means increasing the employability of workers, attracting those who are not part of it, particularly women and young people. It is also important to intervene on the housing factor,” he pointed out, “where in Milan the imbalance is quite evident, but the issue spreads to almost all of the center-north. Fundamental node of competitiveness, as well as that related to ETS and CBAM, instruments created with the intention of reducing emissions from European manufacturing, built to ensure that annually the share of emissions is reduced. A process,” he concluded, “that has accelerated in recent years, with a limitation that raises the price of carbon for those working in the sector. This certainly causes a decrease in competitiveness, from which Italian companies undoubtedly suffer,” Fontana concluded.

(ITALPRESS).

-Photo: Centro Studi Confindustria table.