In the information age, the convergence of technology and finance is radically transforming the way companies operate and compete. Bloomberg represents one of the most iconic realities of this phenomenon, combining data, technology and innovation to revolutionize the financial industry. But what makes Bloomberg so special?

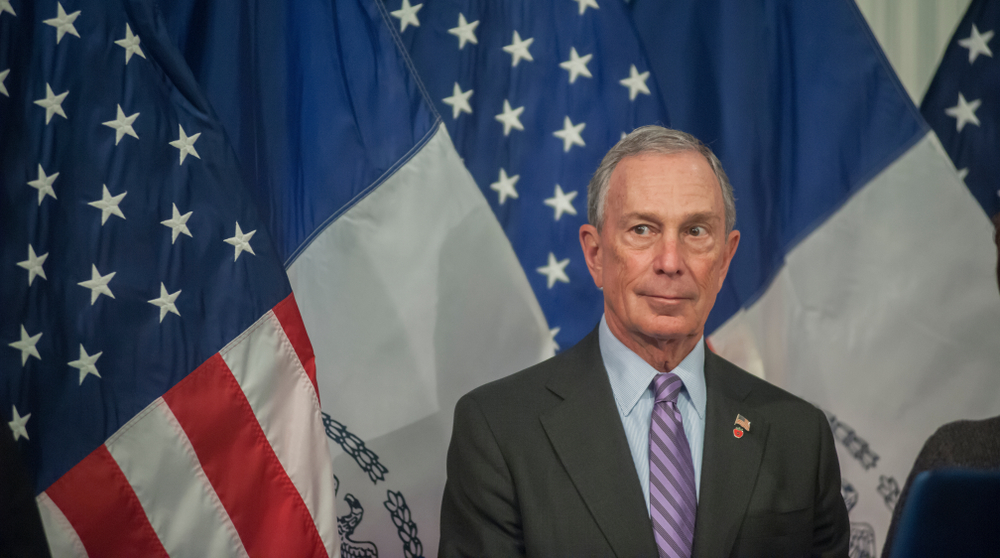

Well, certainly there is the story of Michael Bloomberg, its founder, who began not among the skyscrapers of Wall Street, but in a far more humble setting. Born in Medford, a working-class suburb of Boston, Massachusetts, Bloomberg was not the perfect student, but he did have a strong orientation toward hands-on activities. After an MBA at Harvard, Bloomberg began to question traditional paradigms, exploring new possibilities and imagining an alternative future for the world of finance.

In 1966 Wall Street was a world still dominated by paper and manual calculations. Michael Bloomberg began his career at Salomon Brothers, one of the five largest investment banks in the U.S. and no longer in existence today. Bloomberg started at the bottom: counting stocks in a room with no air conditioning, but the climb to the corporate top was fairly quick, until he became a partner in the bank in 1972.

It was during those years, amid the chaos of the trading floor and the mountains of financial data, that the entrepreneur began to sense the potential of technology. He saw the inefficiency of the systems of the time, the slowness of manual calculations, the difficulty of accessing information in real time, and began to dream of a future where coding could be a game changer.

The B Page project, the first online information system developed for Salomon, represented the first step toward realizing an ambitious vision. This system, revolutionary at the time, aimed to collect and organize market data, prices, and financial information in a digital format that was easily accessible in real time.

Flanked by a small team of programmers, Bloomberg was tirelessly dedicated to creating a tool capable of offering traders quick and intuitive access to market data. However, his ambition went far beyond Salomon: he wanted to create a system that would transform the entire landscape of the financial world.

After years of success at the company, where he had held leadership roles and helped implement innovative technologies, Michael Bloomberg lost his job in 1981 following the acquisition of Salomon Brothers by Phibro Corporation. With the severance he received, about $10 million, Bloomberg founded Innovative Market Systems, which would later become Bloomberg LP. His vision of creating a platform that integrated financial data and technology gave rise to the famous Bloomberg Terminal, revolutionizing the way financial information was used and shared.

To explain what the Bloomberg Terminal is, one need only think of a computer: it is indeed that, a black stationary computer, including a monitor, whose sole role is to provide services to financial analysts. In recounting the effectiveness of his system, Michael Bloomberg himself said it was capable of doing “everything.” Within a few years it became the most widely used tool for financial traders and is still considered indispensable in the industry today: renting one – terminals are not for sale – costs between $20 and $24,000 a year. There are an estimated 325,000 of them worldwide.

Un Bloomberg Terminal in funzione

The Bloomberg Terminal, however, represented not just a technological advance, but a genuine turning point in the industry. At a time when financial data was difficult to obtain and often inaccessible, the platform provided real-time information, detailed analysis, and advanced tools for managing and understanding global markets.

Every aspect of the Bloomberg Terminal was designed to meet the needs of traders, analysts and investors, making it a revolutionary tool. The ability to access real-time data, thanks to a network of distributed servers, allowed users to obtain up-to-the-second market news and prices. The intuitive interface, while initially designed for a niche of experts, proved so effective that it became indispensable for all financial professionals. The Bloomberg Terminal also enables data analysis through interactive Charts with which users can compare historical performance, analyze trends, and simulate future scenarios. It also contains exclusive Datasets with detailed financial information, including corporate balance sheets, analyst forecasts, and ESG sustainability metrics.

Although the Terminal is known for its depth and breadth, its use is based on a few key principles that make it accessible and highly functional.

To access the Bloomberg Terminal, the user uses a multifunctional keyboard, featuring colorful keys and specific commands. This keyboard, an icon of the Terminal, provides an optimized physical interface to navigate through the various menus and functions quickly and efficiently.

L’apposita tastiera multifunzione del Bloomberg Terminal

At the heart of Bloomberg Terminal are its controls. Each function or screen is associated with an alphanumeric code that allows immediate access to it. For example:

WEI per i principali indici economici globali.

GP per grafici personalizzati sulle performance di mercato.

FA per analisi finanziarie di aziende specifiche.

Commands are often followed by the name of a company, stock, or market to quickly access relevant information.

The Terminal integrates a continuous stream of news from Bloomberg News and other authoritative sources, filtered and customizable to the user’s interests. This provides a competitive advantage by allowing users to stay up-to-date on global events affecting markets.

In addition to data, the Terminal offers a unique communication platform, Bloomberg Chat, which allows users to connect with other financial professionals, analysts, and traders in real time. This tool encourages information exchange and collaboration.

Originally available only as native software for Windows-based computers, the team was able to develop Bloomberg Anywhere through a partnership with Citrix Systems. This solution allows users to access their Terminal session from any Internet-connected device, including tablets, smartphones and computers running Mac OS.

In the future envisioned by Bloomberg, technology will continue to democratize access to financial information, making markets more transparent and inclusive.

Ultimately, the Bloomberg Terminal is not just a tool, but an entire ecosystem that continues to redefine the way the world of finance operates, proving that coding and technology are indispensable allies in the digital age.

In addition, Bloomberg Terminal includes a powerful tool called Bloomberg Query Language (BQL). This query language allows users to perform complex, custom searches on financial data, offering a level of flexibility and power beyond simple graphical interfaces. BQL allows users to extract, manipulate, and analyze large amounts of data in real time, making Terminal a true ally for modern finance.

Here is an example of a snippet in Bloomberg Query Language (BQL) that shows how financial data can be extracted and analyzed:

// Query to get the last 5 closing prices of Apple Inc. (AAPL US Equity)

SECURITY(“AAPL US Equity”)

| GET(PRICE(CLOSE))

| SORT(DATE, DESC)

| HEAD(5)

This BQL snippet selects the stock “AAPL US Equity” (Apple Inc. in the U.S. market), gets the closing prices (PRICE(CLOSE)), sorts the results in descending date order (SORT(DATE, DESC)), returns only the first 5 results (HEAD(5)).

But behind its simple interface lies a software architecture of considerable complexity. Designed on a proprietary system with custom hardware and software, the terminal has had to adapt to evolving technology. It has thus integrated new features, handled an increasing volume of data, and ensured compatibility with different platforms.

Bloomberg Terminal is never static. The platform is constantly evolving to adapt to new user needs and take advantage of emerging technologies. Recent integrations with artificial intelligence and machine learning, for example, enable increasingly accurate predictive analytics, improving users’ decision-making ability.

Integration with programming languages such as Python and R offers the ability to create custom models, enhancing the efficiency and accuracy of analysis. A perfect marriage of technology and practicality, it changed the way of working in the world of finance forever.

The integration of artificial intelligence (AI) and finance is one of Bloomberg’s main focuses in the 21st century. With billions of data generated every day, AI presents a unique opportunity to analyze trends, predict market movements, and reduce risk.

Advanced algorithms are automating trading processes, offering fast, data-driven decisions. Bloomberg uses neural networks and machine learning to provide detailed insights into global markets. Users can create customized dashboards that reflect their investment priorities and strategies.

The challenge for the programmers was to maintain the intuitiveness of the interface while expanding the capabilities of the system. They had to develop sophisticated algorithms for data management, optimize the code to ensure maximum performance, and adapt the system architecture to new technologies.

Data management is another crucial element of Bloomberg Terminal’s coding. The terminal processes an enormous amount of information from a myriad of sources, from stock exchanges around the world to company financial statements, from real-time news to economic and macroeconomic data, from market analysis to trading flows. The code must be able to aggregate, process, normalize, and display this data efficiently and reliably, ensuring accuracy, timeliness, and consistency of information.

Un schermata di Bloomberg da iPad con diversi dati economici

To address this challenge, the Bloomberg team has developed a state-of-the-art technology infrastructure, using powerful and flexible programming languages, distributed databases, and machine learning algorithms. The code, which is constantly optimized and updated, is capable of handling huge volumes of data in real time, providing finance professionals with the tools they need to make informed decisions.

The evolution of Bloomberg Terminal from the proprietary system of the 1980s to modern cloud platforms is a testament to the development team’s ability to adapt and innovate. The system’s distributed architecture, based on a global network of interconnected servers, ensures the scalability, resilience and reliability of the service, enabling hundreds of thousands of users worldwide to access data simultaneously, 24/7.

But coding at Bloomberg Terminal is not just about technology. It is also a story of creative problem-solving, adaptability to user needs, and the constant pursuit of excellence. Bloomberg’s team of thousands of programmers, engineers, analysts, and designers around the world work tirelessly to improve the terminal, implementing new features, optimizing the code, ensuring the security and reliability of the system, and anticipating the future needs of the financial market.

Today, Bloomberg is synonymous with innovation in the financial sector, and the Terminal remains an essential tool for those operating in the markets.

The combined effect of coding and advanced technologies is directly reflected in global finance. Bloomberg not only makes markets more accessible, but also raises standards of transparency, reliability and speed. AI and coding-based tools are not exclusive to insiders: they also have an impact on end consumers, improving the overall efficiency of the financial system.

Bloomberg provides a concrete example of how technology and coding can transform entire sectors of the economy. Through the work of the CTO (Chief Technology Officer) and his team, the company integrates the best of machine learning, artificial intelligence, and programming techniques to deliver cutting-edge solutions. This marriage of strategic vision and technology implementation has not only redefined the financial industry, but continues to shape the future of global innovation.

Bloomberg article: the evolution of finance in the digital age comes from TheNewyorker.