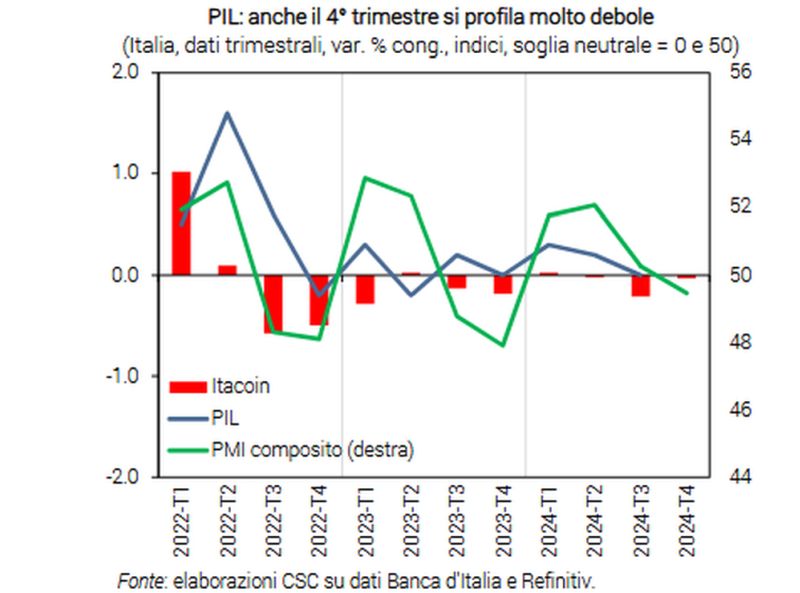

ROME (ITALPRESS) – 2025 opens with rising energy prices, weighing on inflation and business costs, and fears of tariffs that would affect exports, which are already weak. But falling rates, which ease financial conditions, and the implementation of the NRP will continue. In Q4 2024, GDP dynamics in Italy were sluggish, amid modest growth in services and industry still struggling. This is according to the Confindustria Study Center’s Flash Conjuntuira.The RTT index (CSC-TeamSystem) reports a rebound in services turnover in November and growth gained in Q4. In December, the PMI climbed back into the expansionary area (50.7 from 49.2) and business confidence in the sector also rebounded. That of tourism businesses is at an all-time high, even though foreigners’ spending had suffered its first decline since 2024 in October (-5.9% annual rate). Output in November (+0.3%) rose on the month, following October’s marginal recovery, and now the acquired change in Q4 is +0.1% (-0.5% in Q3, 6 consecutive quarters of decline). The modest recovery is confirmed by the December rebound in the HCOB PMI, still at recessionary levels (46.2 from 44.5). The industry RTT, on the other hand, indicates a 4th quarter decline in turnover. December shows a moderate rise in business confidence (95.3, up from 93.2). Instead, demand, as measured by orders for goods, falls (balance at -22.5, from -21.9), both on the domestic and foreign markets. In addition, investment conditions worsened in the 4th quarter (-11.3 from -7.7;Bank of Italy survey). Overall, the picture for investment remains negative at the end of 2024. Continued in November the decline in retail sales (-0.6% in volume), as in October (-1.0% the acquired change in Q4); down both food and non-food goods. Household confidence, down in all months of the quarter, also confirmed the consumption correction, after jumping in the 3rd due to the partial return of the savings rate (9.2% from 10.0%). Employment growth almost stopped at the end of 2024: +0.1% in October-November over Q3 (after +0.4%). At the same time, the sharp decline in job seekers (-6.6%) signals a smaller labor force, which could limit prospects for future job growth. Italian goods exports remain weak in Q4 (-0.2% in Oct-Nov over Q3).Negative dynamics in EU markets (-0.9%), including Germany and France. Timid extra-EU increase (+0.6%): good in UK and Turkey, bad in US (-11.0% annual in November) and China (-19.2%). Strong declines for transportation equipment (-17.3%) and textiles-clothing-footwear (-9.0%). The outlook remains weak, according to foreign manufacturing orders in December, even for world trade. Significant risks pose possible U.S. duties, the second largest destination for Italian exports with more than 22 percent of non-EU.(ITALPRESS).-Photo: Centro Studi Confindustria-