The Btp Più, the new retail government bond designed for the widespread audience of savers, closed its placement with extraordinary results, touching the 15 billion mark. Launched last Monday, the new Btp attracted exceptional interest, drawing the attention of thousands of investors who responded enthusiastically to the proposal of a minimum investment of only 1,000 euros. Already on the first day of the placement, which took place on Monday, Feb. 17, the Btp Più raised 5.6 billion, a figure that exceeded expectations. In the following days, the trend remained positive, with 3.7 billion raised on the second day, 2.8 billion on the third, and finally 1.7 billion on the fourth. At the close of the placement this morning, the total amount raised reached 14.9 billion, with more than 39,700 contracts signed and an average ticket of about 27,500 euros, a sign of the high participation of savers of different categories.

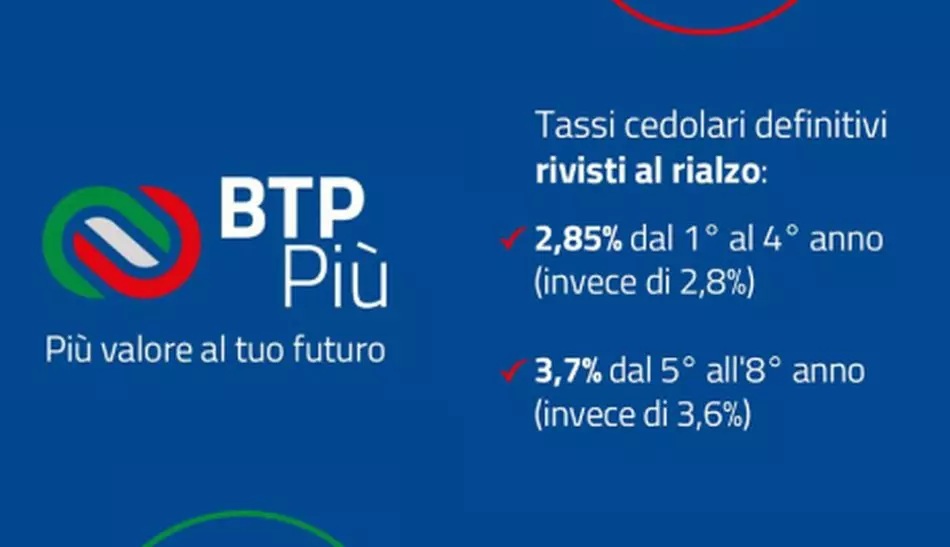

One of the main reasons for the success of Btp Più was the competitiveness of its interest rates, which were then adjusted to market conditions. Indeed, the Mef announced an increase in coupons: from 2.8 percent to 2.85 percent for the first four years, and from 3.6 percent to 3.7 percent for the following years. This decision, made in response to market performance, helped to further strengthen the attractiveness of the bond, offering an increasing and advantageous yield for those who decided to invest in it. It was not only the yield that convinced savers. The Btp Più impressed with its eight-year maturity, safety of principal, and protection offered to investors. One of the bond’s main innovations is the early redemption option at par, available from the fourth year, which provides greater flexibility and security for those who choose to join the issue. The Btp Più has responded to the security and yield needs of Italian investors, with a particular focus on a retail audience seeking stable solutions for their savings. Unlike previous bonds, the Btp Più does not include a loyalty premium, but introduces the innovative early redemption option at par, which represents an added value for those who choose to invest in the medium to long term. Also favoring adherence to the Btp Più was the preferential taxation moreover common to all government debt securities: with capital gains tax set at 12.5 percent, exemption from inheritance taxes, and, as provided by the Budget Law 2024, exclusion from the calculation of Isee up to 50 thousand euros. A combination of tax advantages and a growing yield made the product even more attractive. The success of this issue is part of a broader upward trend in benchmark Btp yields. Specifically, the rate for the eight-year bond rose from 3.26 percent to 3.33 percent, while the four-year bond saw an increase from 2.64 percent to 2.69 percent. These increases testify to the positive development of the Italian bond market and the growing appreciation for government bonds.

The Btp Più operation is part of an effective communication strategy that has been able to engage the public in a targeted way. Already in 2024, communication campaigns for other Btp issues had achieved remarkable results, and this year was no different. The effectiveness of the institutional communication actions was emphasized by the Department of Information and Publishing of the Presidency of the Council, which recognized the relevance of the message conveyed. In summary, the placement of the Btp Più represents a real triumph for the savings of Italians, with a massive response from investors, a solid performance in terms of funding, and an interest rate policy that was perfectly adapted to the economic environment. With these numbers, the Btp Più establishes itself as one of the most promising savings and investment solutions for the near future.

(ITALPRESS).

-Photo: Ministry of Finance-.