Over the past three years, the international sanctions landscape has changed with a rapidity that has put pressure on entire production chains: think of measures linked to conflicts in Ukraine and the Middle East or restrictions on dual-use technology to China-that is, products or software that serve civilian purposes but can also be used for military or security applications. A company that enters into a contract today may find out tomorrow that its partner has been blacklisted.

The risk is not theoretical: a container stopped in customs because the bank blocks payment, a parts order cancelled due to “exposure to sanctioned parties,” current accounts frozen due to violation of anti-money laundering regulations. These incidents result in direct economic losses, production delays, and, often, heavy media exposure.

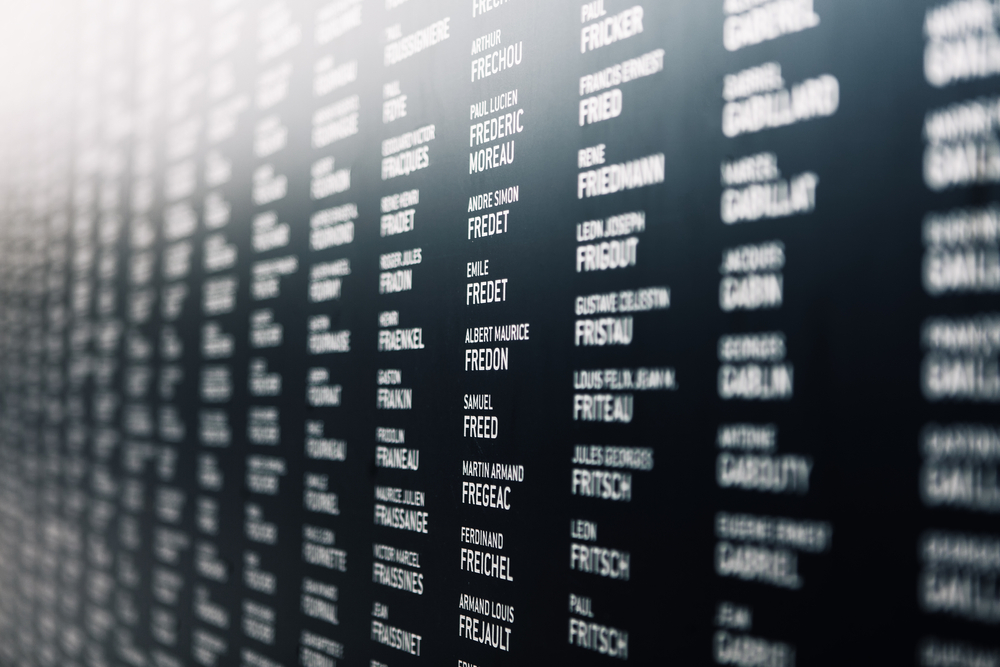

There are four main lists to monitor: OFAC (United States), the European Union’s Consolidated List, UN sanctions, and HM Treasury of the United Kingdom. These are supplemented by specific national blacklists and, in many areas, anti-corruption or counterterrorism databases maintained by multilateral institutions.

In addition to sanctioned entities, there are PEPs, Politically Exposed Persons, and so-called criminal lists: individuals or companies at the center of criminal investigations not yet subject to restraining orders but deemed at risk. Neglecting them means exposing oneself to future allegations of negligence.

Best practices involve two separate checks. The first is initial screening (KYC, Know Your Customer), to be performed before signing any contract. The second is ongoing monitoring: updating partner profiles whenever official lists change, because the addition of a name can suddenly make a business relationship noncompliant.

Operationally, an effective Anti-Money Laundering (AML)/KYC process starts with the exact identification of the company and its beneficial owners. It then moves on to name-matching, a search that uses disambiguation algorithms to distinguish homonyms and reduce false positives, a crucial aspect when working with lists of tens of thousands of entries.

To prioritize alerts, many firms rely on a risk score that combines different factors: presence on sanctions lists, negative media exposure, commodity sector, jurisdiction of residence, and corporate history. A high-rated partner requires manual verification and approval at the executive level.

There are three typical mistakes. First: considering screening a “one-time” formality and not a cyclical process. Second: using unofficial or outdated databases, often in Excel format, with no audit trail. Third: ignoring the real control structure, stopping at the first level of holdings without tracing back to the real owners or trusts.

Supervisors have shown little tolerance for these failures: between Europe and the United States, total AML fines in 2023 exceeded ten billion dollars. Financial institutions are no longer the only ones in the crosshairs; manufacturing and e-commerce companies have also suffered penalties for insufficient controls.

In export-driven industries, a good practice is the direct integration of screening within Enterprise Resource Planning (ERP), the integrated information systems that link business processes, or supply-chain management systems. Each purchase order is “frozen” if the supplier or destination country exceeds certain risk thresholds-a freeze that prevents already paid-for goods from being sent to sensitive destinations.

Even SMEs, which often lack dedicated compliance departments, can reduce costs by automating verification through SaaS platforms connected via API. The important thing is to keep a complete audit log: in the event of a Finance Guard inspection or bank audit, documentary evidence is what differentiates a sanction from a filing.

After the implementation of controls, the issue of internal training remains. Commercial agents and buyers must know how to recognize warning signs: a sudden change of payee, split payments, shell companies in offshore jurisdictions. No software can replace the intuition of those who deal with suppliers and customers on a daily basis.

I often act as an external consultant on these issues. When asked what is the real difference between a compliance system that works and one that fails, I answer that it is not so much the technology itself, but its integration into a clear process with defined responsibilities and certain updates.

At Telejnform, we have developed a data-hub that cross-references more than forty sanction lists, updates alerts in real time, and assigns a unified score. The system does not replace human analysis, but it dramatically reduces false positives and provides a document base that stands up to any audit.

Staying compliant with international regulations is not just a matter of avoiding fines-it is a competitive advantage. A company that can demonstrate timely and transparent screenings is more attractive to investors, lenders, and large global customers. In a regulatory environment that is bound to become even more complex, the difference will be made between those who organize now and those who will find themselves, tomorrow, with containers stopped in port and little explanation to give.

The article What is at risk if customers or suppliers are sanctioned or blacklisted? comes from TheNewyorker.