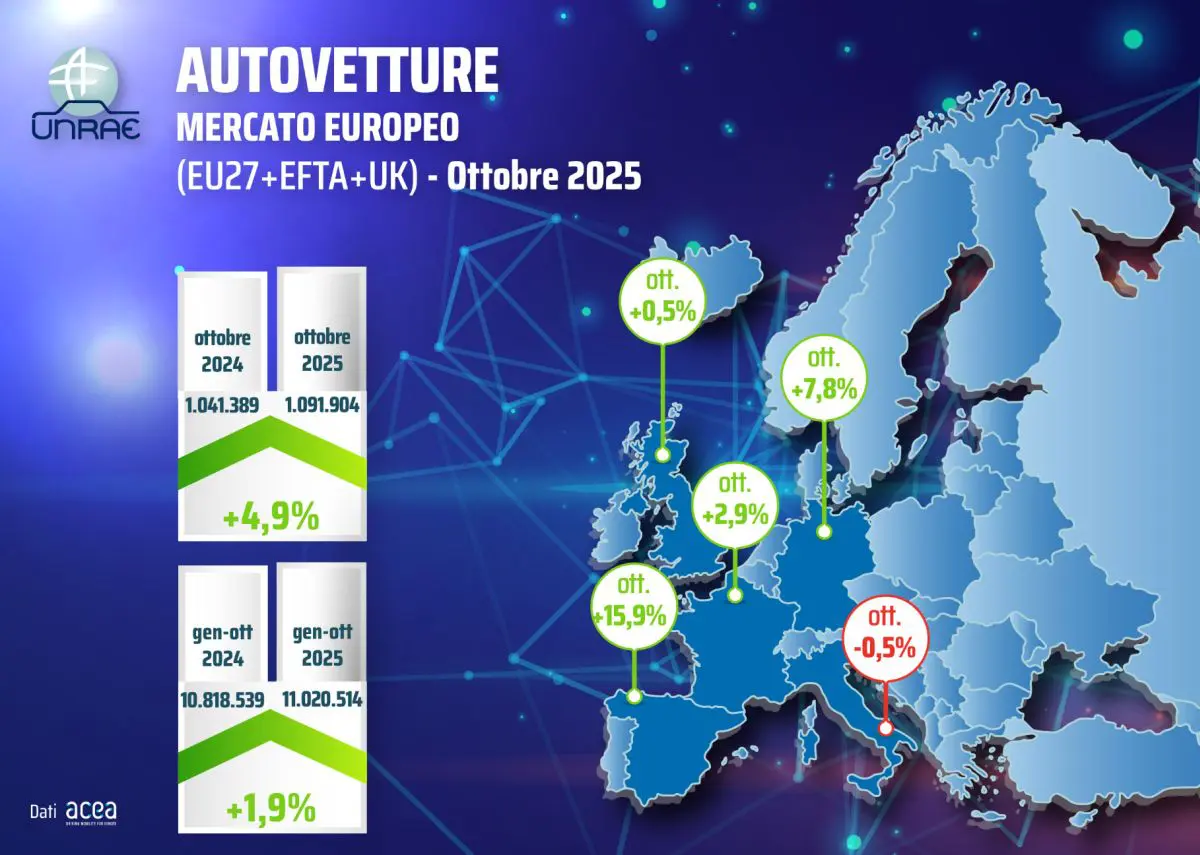

ROMA (ITALPRESS) – The positive trend of the European motor vehicle market continues, recording in October a growth of 4.9% with 1.091.904 registrations compared to the 1.041.389 units of the same month of 2024. In January-October the European market totaled 11,020.514 registrations: an increase of 1.9% compared to 10,818.539 in the first ten months of 2024.

However, comparison with 2019 still highlights a significant gap: -10.1% in October and -17.3% in 10 months. Analyzing the trend of the main markets, a situation differentiated between the 5 Major Markets emerges.

Spain stands out for the most brilliant performance, with a +15.9% in October and +14,9% in the cumulation. Germany recorded a +7.8% in the month, but progress in ten months is limited to 0.5%. France follows with a growth of 2.9% in the month, but in contraction of 5.4% in the ten months. In active also the United Kingdom, which shows a +0.5% in October, but a +3.9% in annual cumulation.

Italy, which confirms its fourth position both in the month and in the cumulation, represents the only negative note among the main markets, recording a bending of 0.5% to October and of 2.6% in 10 months. As for rechargeable vehicles, in October Italy ranked the last place among the Major Markets with a total ECV share of 12.2%, divided between 5.0% of electric cars as well (BEV) and 7.2% of plug-in hybrids (PHEV).

The gap compared to other major European markets is particularly evident: the UK reaches 37.5% with 25.4% of BEV and 12.1% of PHEV, Germany reaches an ECV share of 33.4% with 21.0% of BEV and 12.4% of PHEV, France stands at 31.1% with 24.4% of BEV and 6.7% of PHEV, while Spain accounts for 22.4% with In the total European market, ECVs cover 31.3% share with BEVs at 20.6% (+4.3 p.p.) and PHEV at 10.7% (+ 2.7 p.p.). Also in the period January-October the Italian situation is critical with a share of ECV to 11.2%, of which 5.2% of BEV and 6.0% of PHEV, compared to 33.4% of the United Kingdom (BEV 22.4% and PHEV 11.0%), to 28.9% of Germany (BEV 18.4% and PHEV 10.5%), to 25.1% of France (BEV 18.9% and PHEV In the total European market, ECVs cover 27.7% share with BEVs at 18.3% (+3.5 p.p.) and PHEV at 9.4% (+2.2 p.p.).

On the institutional front, the announcement of a legislative proposal from the European Commission on the revision of the regulations relating to cars and light commercial vehicles of new registration is planned on 10 December. This review will include not only the standards for CO2 emissions, but also a strategy for strengthening the battery industry, a regulatory simplification package for the automotive industry and a proposal dedicated to electrification of business fleets.

In this regard, on 7 November the ACEA, the Association of European Constructors, highlighted the increasing difficulties in achieving the European objectives on CO2 emissions set for 2030 and 2035, calling for “a more pragmatic and realistic approach that takes into account the specific challenges of the sector and fosters a competitive transition towards zero-emission mobility driven by consumer choices”.

With regard to the incentives of MASE for the purchase of electric vehicles, UNRAE points out that about 55,700 vouchers issued between 22 and 23 October, at 10.00 on Saturday 22 November approximately 47,000 were valid. The resources corresponding to more than 8,000 vouchers are therefore available within the expected 30-day deadline, which were once again exhausted on Sunday 23rd.

The numbers of October continue to highlight Italy’s strong distance from the other 30 European countries regarding the BEV car share, 5.0% versus 22.7%: a value of 4.5 times lower. The month is still affected by the expectation of incentives, which – operating only from the last day – will show their impact on November.

As UNRAE has emphasized for years, to promote the development of zero-emission mobility in Italy in a stable way, without a succession of accelerations and brakes, a revision of the fiscal treatment of corporate cars, through interventions aimed at detraibility of VAT, deductibility of costs and period of amortization. The Fiscale Delegation, extended until 31 December 2026, is an unmissable opportunity to implement these actions. Other priorities for speeding up the energy transition include the widespread development of the charging infrastructure and the reduction of charging costs to make them more accessible to users.

“UNRAE welcomes the allocation of EUR 600 million, which has been formalised in recent days by the European Commission, for 70 projects to implement alternative fuel infrastructure in 24 countries,” says Andrea Cardinali, Director-General of UNRAE.

“The aim is to stimulate sustainable investments in urban areas and along the road routes of the TEN-T trans-European transport network – Cardinals continues – with a praiseworthy focus on heavy vehicles. It remains to be evaluated the congruity of the funds regarding the number of interventions planned, and their ability to fly for private investments”. “Now everyone’s eyes are focused on the announcement scheduled for December 10th. – the Director-General concludes – The market has been waiting for more than 2 years for the necessary clarity on European regulations, indispensable for customers and operators”.

photo: Unrae press office

(ITALPRESS).